U.S. President Donald Trump has just threatened to immediately impose a 100% tariff on goods imported from Canada if the country proceeds with a preliminary trade agreement with China. The move has raised concerns over potential disruptions to North America’s automotive and energy supply chains, despite commitments under the USMCA.

Logistic News

SHIFT’S PREDICTIONS SHOW DRAMATIC RETREAT IN SPOT RATES

July 29, 2022

Port of Los Angeles

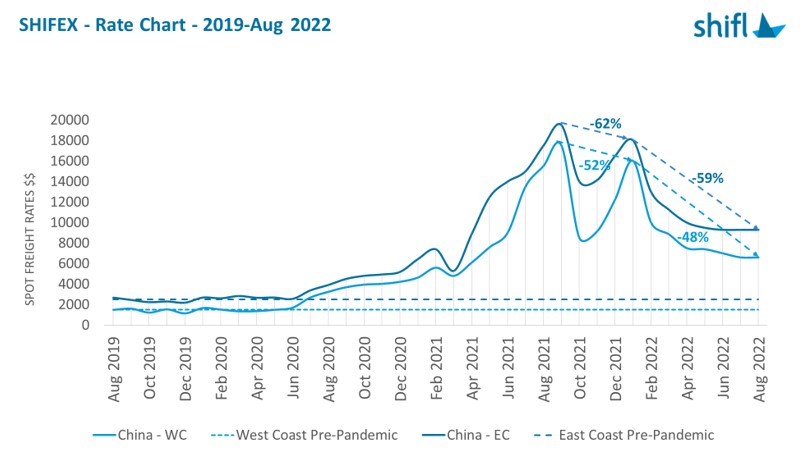

According to early indications from SHIFEX, the freight rate index by the digital freight forwarding platform Shifl, box prices on the main Trans-Pacific trade lanes declined, during the third quarter of the year, more than 50% from the September 2021 peak, falling at levels not seen since the beginning of last year.

The reasons for the sharp reversal in rates in the first half of the year are the sharp decline in demand associated with the tightening of monetary policy around the world, the shift in consumer spending from goods to services, inflated retail inventories in the US and Europe combined with the dramatic decline in production in China.

At the same time, international shipping companies are under increasing attack for their role in fueling inflation, with the US Congress passing a bipartisan bill in June aimed at preventing future freight rate hikes and adding extra capacity for exporters.

The US Federal Reserve raised its key lending rate by 75 basis points in July to counter rising inflation, which hit 9.1% in the same month, its highest level in 40 years.

“Inflation, coupled with softening demand for goods as consumers allocate more money to eating out and holidays, has prompted US lawmakers to step up their efforts to curb runaway prices in the world’s biggest economy through various pieces of legislation such as the Ocean Shipping Reform Act 2022,” said Shabsie Levy, CEO, and founder of Shifl.

Due to reduced demand, ocean spot freight rates for a 40' container from China to Los Angeles decreased by 62% in July 2022 compared to September 2021 and by 59% compared to January 2022, reaching US$6,600.

Rates from China to New York fell 52% in July 2022 compared to September 2021 and 48% compared to January 2022, reaching US$9,300 in July 2022.

Although these rates are still a long way from the pre-pandemic levels of US$1,350/FEU and US$2,850/FEU in March 2020 on the US West and East Coasts, respectively, this decrease is still a relief for the shippers.

Meanwhile, Shifl reported that retail inventories continued to climb to record levels, up 2% in May to US$705 billion, raising the prospect of cargo backups at ports and onshore.

“Congestion continues to play a major role in keeping spot rates higher than pre-pandemic levels, and with shelves and warehouses fully stocked, we’ll probably see more containers sitting on the dock or at railway yards for longer periods as we move into the second half of the year,” noted Levy.

According to data tracked by Shifl, container dwell times have been steadily increasing over the past three months.

It is important to note that while a container took an average of four days to leave the port in May 2022, this number increased to five in June and six in July.

Climbing dwell times once again raises the prospect of a container dwell fee — a measure introduced at the Ports of Los Angeles and Long Beach in October that allows the ports to charge ocean carriers US$100 for each import container that stays nine days or more in the terminal. However, the implementation of the fee has been postponed every month by both ports, until now.

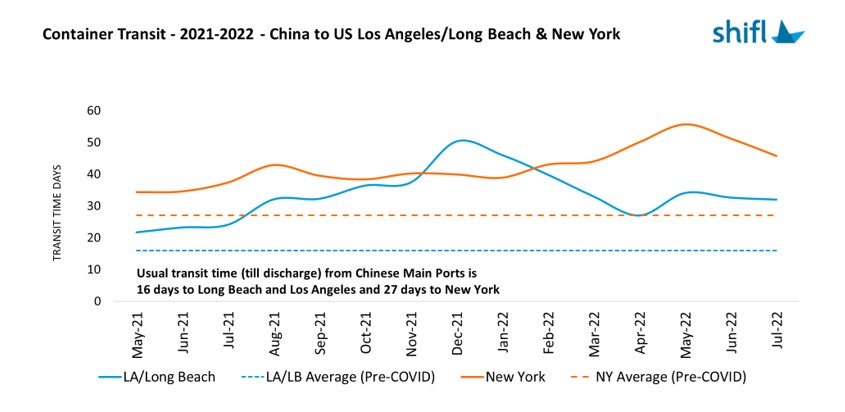

It should be noted that there was an overall decrease in transit times on the main trades to the East and West Coast of the USA in July, maintaining a downward trend that began in May.

Transit times from China to US West Coast ports decreased from 34 days in May to 32 days in July. The improvement was most noticeable on ships sailing to the US East Coast, with transit times from 56 days to 46 days, down 18% from May.

“The off-peak season has enabled carriers to reduce some of the issues they were having with service reliability, but the transpacific trade lane and the all-water route to the US east coast are still way above their respective historical averages of 16 and 27 days,” commented Levy.

Source: Container-news

Head Office

ASL Hồ Chí Minh

Số 31/34A Ung Văn Khiêm, Phường Thạnh Mỹ Tây, TP. Hồ Chí Minh, Việt Nam

Công Ty Cổ Phần Giao Nhận Vận Tải Mỹ Á

Công Ty Cổ Phần Giao Nhận Vận Tải Mỹ Á

(+84)28 3512 9759

(+84)28 3512 9759

(+84)28 3512 9758

(+84)28 3512 9758

pricing@asl-corp.com.vn

pricing@asl-corp.com.vn

mdirector@asl-corp.com.vn

mdirector@asl-corp.com.vn

www.asl-corp.com.vn

www.asl-corp.com.vn

LOGISTICS SERVICES

.png)

.png)

.png)